As an affiliated partner of the G20 Global Partnership for Financial Inclusion (GPFI),

the World Business Angels Investment Forum is committed to collaborating globally to empowering the economic development of the world

G20 - GPFI Statement on COVID-19 Response

As governments around the world have responded to the health, social and economic effects of the COVID-19 pandemic, digitalization has been recognized as being of paramount importance and relevance in ensuring continuity of access to financial services. The G20 Global Partnerships for Financial Inclusion (GPFI) members issued a Statement on COVID-19 Response, reaffirming the G20 commitment under the G20 Action Plan in response to the COVID-19 pandemic, to which the World Business Angels Investment Forum is one of the signatories.

It is rewarding to see that governments around the world have understood the importance of angel investment for boosting their economies.

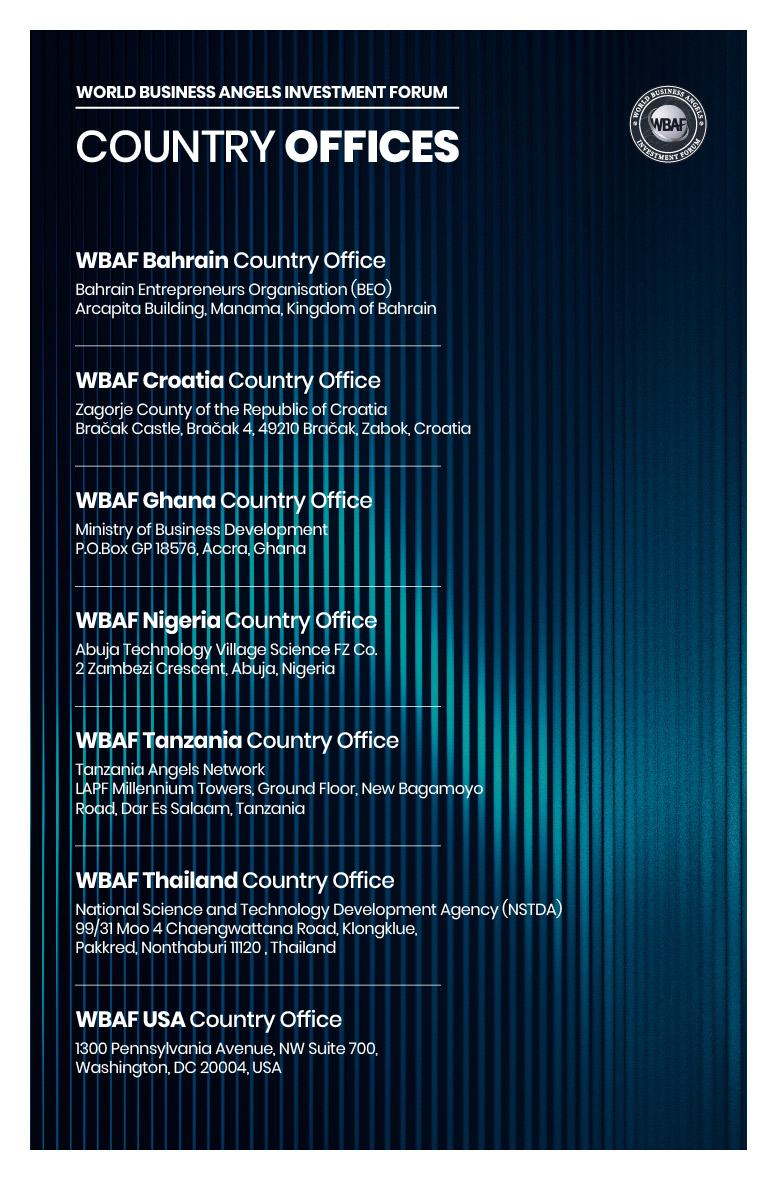

World Business Angels Investment Forum

As an affiliated partner of the G20 Global Partnership for Financial Inclusion (GPFI), the World Business Angels Investment Forum (WBAF) is committed to collaborating globally to empower the economic development of the world by fostering innovative financial instruments for startups, scaleups, innovators, entrepreneurs and SMEs and to promoting gender equality and women’s participation in all sectors of the world economy. WBAF invites you to join our global efforts to ease access to finance, promote financial inclusion, and create more jobs and social justice.